Physical damage risks are prevalent across industries, requiring proactive measures. Comprehensive fleet insurance is a key strategy offering coverage for accidents, vandalism, theft, and environmental damage. It should be paired with regular maintenance, employee training, and adherence to safety protocols. Identifying potential hazards through systematic assessments and using insurance data to uncover trends fosters a culture of reporting. Implementing risk mitigation strategies, including targeted interventions and advanced safety technologies, reduces accidents and damage. Comprehensive fleet insurance protects businesses from various risks, ensuring swift recovery and continuity, allowing focus on core operations with peace of mind.

In the dynamic landscape of daily operations, minimizing physical damage risks is paramount for businesses. This article guides you through essential strategies to navigate and mitigate potential hazards. From understanding the nuances of common physical damage risks to implementing robust risk management practices, we delve into actionable steps.

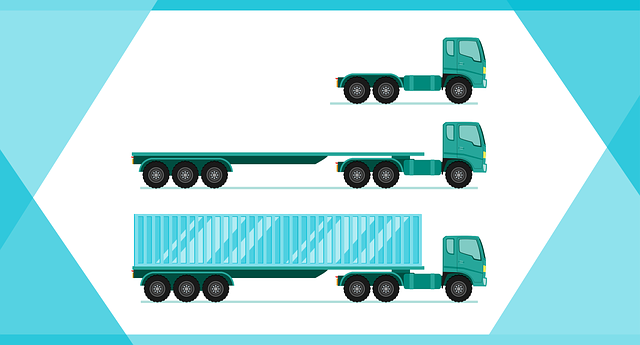

Key topics include assessing hidden dangers, leveraging advanced technologies, and the pivotal role of comprehensive fleet insurance in safeguarding your assets and operations.

Understanding Physical Damage Risks in Daily Operations

In daily operations, physical damage risks are prevalent across various industries, from construction sites to transportation hubs. Understanding these risks is paramount for any organization aiming to protect its assets and maintain smooth operations. Physical damage can stem from numerous sources, including accidents, natural disasters, equipment malfunctions, and human error. Identifying potential hazards and implementing preventive measures is the first step towards mitigating these risks effectively.

Comprehensive fleet insurance plays a pivotal role in this context. By insuring not just vehicles but also their components and operations, businesses can safeguard against unforeseen events. This includes coverage for accidents, vandalism, theft, and even environmental damage. Moreover, regular maintenance checks, proper training for employees, and adherence to safety protocols are essential strategies to minimize physical damage risks in daily operations, ensuring a safer work environment and financial protection for your assets.

Assessing and Identifying Potential Hazards

Identifying potential hazards is a crucial step in reducing physical damage risks in daily operations. It involves a thorough and systematic assessment of all aspects of your work environment and processes. Start by conducting regular safety audits, focusing on areas where accidents are most likely to occur. These may include heavy machinery operation, material handling, or even simple slip-and-fall risks. Utilize comprehensive fleet insurance data and insights to identify recurring issues and trends, ensuring no stone is left unturned in your hazard hunt.

Encourage a culture of reporting where employees feel comfortable identifying potential dangers. Train them to recognize signs of wear and tear on equipment, loose cables, or any other irregularity that could lead to accidents. This proactive approach not only enhances safety but also allows for the implementation of tailored risk mitigation strategies using comprehensive fleet insurance as a robust backup.

Implementing Effective Risk Mitigation Strategies

Implementing effective risk mitigation strategies is a cornerstone in safeguarding operations and assets, especially within the realm of daily transportation. A robust approach begins with assessing every potential hazard unique to your fleet. This meticulous evaluation involves examining both the physical characteristics of vehicles and the environments they navigate. Once identified, risks can be categorized and prioritized, enabling targeted interventions.

One crucial tool in this process is comprehensive fleet insurance. Beyond basic coverage, such policies often incorporate risk management programs that provide tailored solutions. These may include driver training programs, vehicle maintenance schedules, and advanced safety technologies. By integrating these measures, organizations can minimize the likelihood of accidents, damage, and subsequent downtime, ultimately enhancing operational efficiency and financial resilience.

The Role of Comprehensive Fleet Insurance in Risk Management

Comprehensive fleet insurance plays a pivotal role in effective risk management for daily operations, especially in industries reliant on vehicles. This type of insurance offers protection against various risks and liabilities that come with managing a fleet of vehicles. It goes beyond standard coverage by including provisions for physical damage, such as accidents, natural disasters, and vandalism, ensuring that businesses can recover quickly from unforeseen events.

By availing themselves of comprehensive fleet insurance, companies can safeguard their financial health and operational continuity. The policy’s broad scope covers not just the physical vehicles but also provides liability protection, which is crucial for mitigating risks associated with accidents or damage caused to third-party properties. This proactive approach to risk management allows businesses to focus on their core operations, knowing that potential losses are minimized and that they have a reliable support system in place.

By understanding and proactively managing physical damage risks through thorough hazard identification and effective risk mitigation strategies, businesses can significantly reduce potential losses. Comprehensive fleet insurance plays a vital role in this process, providing financial protection against unforeseen events. By combining robust risk management practices with adequate insurance coverage, organizations can ensure the safety of their assets and operations, fostering a more secure and efficient environment for daily tasks.