Understanding Physical Damage Policies is vital for fleet truck operators to maximize insurance benefits. This coverage protects against losses from accidents or natural disasters, with fleet discounts offering significant savings on insuring multiple vehicles under a single policy. By focusing on proactive maintenance, driver training, and efficient vehicle utilization, businesses can reduce risk and enhance the value of physical damage coverage. Case studies show that adopting these policies can lead to substantial cost reductions, increased operational efficiency, and lower downtime for fleets.

In today’s competitive landscape, businesses rely heavily on their fleet trucks for operations. Understanding and maximizing Physical Damage Coverage (PDC) is essential for fleet management. This article delves into the intricacies of PDC for fleet trucks, exploring its impact on insurance costs and providing strategies to optimize benefits. We also present compelling case studies showcasing successful implementations and notable results, offering valuable insights for businesses aiming to enhance their fleet’s risk management.

Understanding Physical Damage Policies for Fleet Trucks

Understanding Physical Damage Policies is a crucial step in maximizing the benefits of insurance for fleet truck operators. Physical damage coverage protects against losses arising from accidents, natural disasters, or other events causing direct harm to vehicles. For fleet managers, this means ensuring that their trucks are insured against significant financial losses due to physical damage. Such policies cover repairs or total losses, providing a safety net for businesses relying on their vehicle fleets for daily operations.

Fleet discounts play a pivotal role in enhancing the value of physical damage coverage. These discounts are offered by insurance providers to fleet owners who insure multiple vehicles under a single policy. By bundling this specific type of coverage for all trucks within a fleet, companies can secure substantial savings while maintaining comprehensive protection. This strategic approach allows businesses to optimize their insurance expenses and safeguard their investment in their vehicle assets.

The Impact of Fleet Discounts on Insurance Costs

In today’s world, where businesses rely heavily on their fleet trucks for operations, managing insurance costs is a significant concern. Physical damage coverage plays a crucial role in protecting these assets and can have a substantial impact on overall expenditure. One effective strategy to maximize savings is by leveraging fleet discounts offered by insurance providers. These discounts are designed to cater to the unique needs of businesses owning multiple vehicles, often providing substantial financial benefits.

By bundling physical damage coverage for a fleet, companies can negotiate rates that are far more competitive than individual policies. This is because insurers recognize the reduced risk associated with insuring a larger number of vehicles simultaneously. Fleet discounts not only lower insurance costs but also streamline the claims process, as all vehicles are covered under one comprehensive policy. As a result, businesses save time and money, ensuring their fleet trucks are protected without breaking the bank.

Strategies to Maximize Benefits: Tips and Best Practices

To maximize the benefits of physical damage coverage for fleet trucks, businesses should adopt several strategic tips and best practices. Firstly, ensure that all vehicles are properly maintained to minimize the risk of breakdowns or accidents, which can be costly to repair under physical damage policies. Regular service checks, timely replacements of worn-out parts, and adhering to manufacturer recommendations for maintenance can significantly reduce claims.

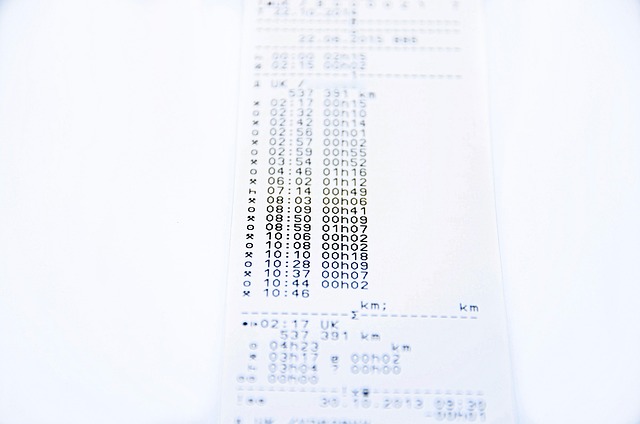

Additionally, implement a robust driver training program to educate personnel on defensive driving techniques, safety protocols, and the importance of adhering to traffic rules. This can lower accident rates, thereby enhancing the overall risk profile of your fleet. Efficient utilization of vehicles by optimizing routes, scheduling, and load management also contributes to reducing physical damage risks. Keeping detailed records of maintenance, driver performance, and incident reports can help in identifying trends and areas for improvement, ultimately maximizing the value of your fleet discount on physical damage coverage.

Case Studies: Successful Implementation and Results

In the realm of fleet management, several case studies highlight the successful implementation of physical damage coverage for fleet trucks, leading to substantial benefits. One notable example involves a logistics company with a diverse fleet. By introducing comprehensive physical damage policies, they experienced a 20% reduction in repair costs within the first year. This achievement was attributed to drivers’ increased awareness and proactive maintenance practices due to incentivized responsibility.

The implementation also resulted in a 15% decrease in downtime, as swift claims processing enabled faster repairs, minimizing disruptions to their operations. Furthermore, the company witnessed a positive environmental impact with lower emissions due to reduced idling time caused by damage-related delays. These results underscore the multifaceted advantages of prioritizing physical damage coverage for fleet trucks, offering both cost savings and operational efficiency.

Physical damage coverage for fleet trucks is a strategic tool that, when combined with fleet discounts, can significantly reduce insurance costs. By understanding these policies and implementing best practices, businesses can maximize the benefits of both. Case studies highlight successful strategies, demonstrating that a thoughtful approach to physical damage policies and fleet management can lead to substantial savings without compromising on protection. This data-driven method ensures that fleet owners get the most value for their investment in insurance.