Fleet managers must differentiate between wear and tear and physical damage to efficiently manage their vehicles. Comprehensive and collision coverage in trucking insurance policies protect against unexpected repair costs for both issues. Small fleet damage policies offer affordable physical damage cover, allowing operators to focus on business without financial strain from repairs. Physical damage coverage is crucial for truck repair insurance, safeguarding fleets from unforeseen events like collisions, natural disasters, and road hazards, minimizing downtime and enhancing operational efficiency. By comparing suitable small fleet damage policies or affordable physical damage plans, businesses can ensure their trucks remain protected without breaking the bank.

In the dynamic world of trucking, understanding the distinction between wear and tear versus covered physical damage is crucial for fleet managers. While regular maintenance can mitigate wear, unexpected events and collisions pose significant risks to fleet vehicles. This article explores essential aspects of truck repair insurance, comprehensive fleet coverage, and affordable options tailored for small fleets, offering valuable insights into protecting your trucking assets from unforeseen challenges. Discover how the right policies can ensure your fleet’s longevity and financial resilience on the road.

Understanding Wear and Tear: Common Issues in Fleet Trucks

Understanding Wear and Tear: Common Issues in Fleet Trucks

Wear and tear is a natural part of aging for any vehicle, including fleet trucks. This refers to the gradual deterioration of parts due to normal usage over time. It’s important to differentiate wear and tear from physical damage coverage fleet trucks experience. While regular maintenance can mitigate some issues, certain problems like cracked windshields, worn-out tires, or faulty brakes often require prompt attention and repairs. Trucking fleet insurance that includes comprehensive and collision coverage for fleets is essential for protecting against unexpected costs associated with these repairs.

Small fleet damage policies tailored to cover physical damage ensure that operators can focus on their core business without being weighed down by unexpected repair bills. Affordable physical damage plans are available, offering peace of mind without breaking the bank. By considering comprehensive fleet insurance and regular maintenance schedules, fleet managers can better protect their vehicles from both wear and tear and sudden physical damage, keeping their trucking operations running smoothly.

The Role of Physical Damage Coverage in Truck Repair Insurance

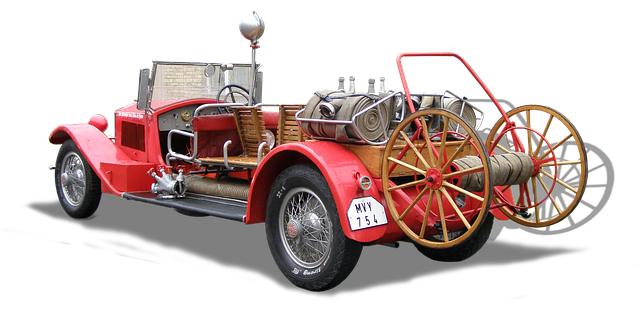

Physical damage coverage plays a pivotal role in truck repair insurance for fleet owners. It protects against unexpected incidents like collisions, accidents, or damage caused by weather conditions, which can lead to substantial repairs or even total vehicle loss. This type of coverage is especially crucial for fleets as it ensures that vehicles remain operational and minimizes downtime, a critical factor in the logistics industry where time is money.

When choosing truck repair insurance, fleet managers should opt for policies that offer comprehensive physical damage protection tailored to their specific needs. Affordable plans are available that cater to small fleets, providing valuable peace of mind without breaking the bank. Collision coverage for fleets and comprehensive fleet insurance options ensure that repairs or replacements are covered efficiently, allowing businesses to focus on their core operations rather than financial burdens.

Comprehensive Fleet Insurance: Protecting Against Unforeseen Events

Comprehensive Fleet Insurance plays a pivotal role in safeguarding against unforeseen events that can lead to both wear and tear and sudden physical damage for truck fleets. Unlike standard auto insurance, which typically covers only accidents and specific types of damage, fleet vehicle protection goes above and beyond, offering collision coverage and truck repair insurance in one comprehensive policy. This ensures that fleet operators don’t face unexpected costs from routine maintenance or sudden incidents like collisions or natural disasters.

For small fleets, affordable physical damage plans are available, providing peace of mind without breaking the bank. These policies cater to diverse trucking needs, ensuring that every journey is secure and that vehicles are protected, regardless of their age or mileage. By investing in comprehensive fleet insurance, businesses can minimize downtime and keep their trucks on the road, ultimately enhancing operational efficiency.

Affordable Options for Small Fleet Damage Policies: A Guide

For small fleet operators, managing repair costs and minimizing downtime is paramount to keeping businesses running smoothly. While major accidents may require specialized coverage, many daily wear-and-tear issues can be addressed through affordable physical damage plans tailored for trucks and fleet vehicles. These policies offer comprehensive fleet insurance that goes beyond collision coverage, often including provisions for road hazards, natural disasters, and vandalism – common causes of minor but costly repairs.

By opting for a small fleet damage policy, businesses can access truck repair insurance that fits their budget without sacrificing protection. This proactive approach allows operators to focus on safety, efficiency, and growth rather than unexpected repair bills. With careful comparison shopping, you can find affordable physical damage plans that provide the necessary coverage for your fleet vehicles at a price point that won’t break the bank.

When it comes to protecting your trucking fleet, a well-rounded insurance plan is key. By understanding the distinction between wear and tear and covered physical damage, fleet owners can make informed decisions regarding their vehicle maintenance and repair coverage. Truck repair insurance plays a vital role in mitigating financial burdens associated with unexpected events, while comprehensive fleet insurance offers a safety net against various risks. For small fleets, affordable physical damage plans provide accessible solutions without compromising on essential protection. Ultimately, selecting the right coverage ensures your vehicles remain in top condition, minimizing downtime and maximizing operational efficiency.