TL;DR: Physical damage coverage for fleet trucks, or truck repair insurance, is crucial for businesses relying on their fleets for daily operations. It safeguards against unexpected repairs from wear and tear, accidents, extreme weather, and vandalism, minimizing financial burdens and downtime. Comprehensive and collision coverage are key components, with comprehensive protecting non-traffic incidents and collision covering accidents. Policies should include tow services, roadside assistance, and align with specific fleet needs regarding repair types and costs. Thoroughly review policies to ensure adequate protection without overpaying.

In the dynamic world of trucking, ensuring your fleet’s protection against unexpected physical damage is paramount. This article guides you through the essentials of understanding and securing comprehensive truck repair insurance. From defining what physical damage coverage entails to highlighting its significance for business continuity, we explore key components and offer insights on choosing the ideal policy to safeguard your investment. Discover why this coverage is indispensable for managing risks and minimizing downtime in your trucking operations.

What is Physical Damage Coverage for Fleet Trucks?

Physical Damage Coverage for Fleet Trucks is a crucial aspect of fleet management, offering protection against unexpected and costly repairs. This type of insurance covers damages to vehicles that are not caused by accidents but rather by external factors such as extreme weather conditions, natural disasters, or vandalism. By providing this coverage, fleet owners can ensure their trucks remain in top condition without the financial burden of unexpected repair bills.

It acts as a safety net, safeguarding against significant expenses related to truck repairs and maintenance. This is particularly important for businesses relying on their fleets for daily operations, as it ensures minimal downtime and maintains productivity. With physical damage coverage, fleet managers can focus on operational efficiency knowing that potential issues due to non-accidental events are mitigated by the insurance policy’s benefits.

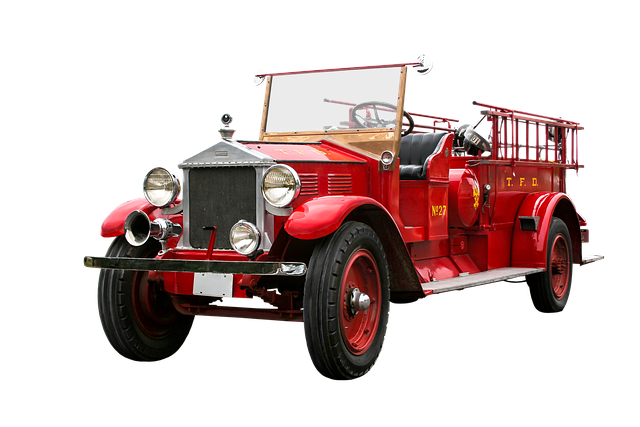

Why is Truck Repair Insurance Important?

Truck repair insurance plays a pivotal role in safeguarding fleet operators from unexpected and often costly repairs. It acts as a financial safety net, ensuring that routine maintenance and sudden accidents don’t cripple your business with astronomical bills. In the dynamic world of trucking, where vehicles are constantly on the move, wear and tear is inevitable. Regular insurance plans might not always cover these expenses, leading to significant out-of-pocket costs.

Having comprehensive truck repair insurance means you’re prepared for various scenarios, from engine failures to fender benders. It allows for quicker turnaround times, as claims can be processed efficiently, minimizing downtime for your fleet. This, in turn, enhances operational efficiency and customer satisfaction, ensuring that your trucking business remains competitive and resilient in a dynamic market.

Key Components of Physical Damage Coverage

When considering physical damage coverage for fleet trucks, several key components come into play. These include comprehensive and collision coverage, which are designed to protect against a wide range of incidents from accidents to natural disasters. Comprehensive insurance covers damages caused by events unrelated to traffic, such as theft, vandalism, or severe weather, while collision coverage kicks in during accidents, regardless of fault.

Additionally, truck repair insurance often includes provisions for tow services and roadside assistance, ensuring that your fleet can quickly return to the road after an incident. It’s also crucial to understand deductibles and coverage limits, which vary among policies. Choosing the right levels will balance cost and peace of mind, ensuring your trucks receive the necessary repairs without a significant financial burden.

How to Choose the Right Truck Repair Insurance Policy

When selecting a truck repair insurance policy, it’s crucial to assess your specific needs and understand the scope of coverage offered by different providers. Start by evaluating the types of repairs your fleet trucks typically require—is it primarily mechanical or does it include extensive body work? This will help you identify policies that align with your costs and frequency of claims. Look for comprehensive plans that not only cover routine maintenance but also unexpected, costly repairs.

Consider additional benefits like roadside assistance, rental coverage during repairs, and policy flexibility to accommodate varying fleet sizes and usage patterns. Read the fine print carefully to understand deductibles, exclusions, and limits. Engaging with insurers who specialize in commercial vehicle insurance can offer valuable insights into the best policies for your fleet’s unique needs, ensuring you’re adequately protected without paying for unnecessary coverage.

Physical damage coverage for fleet trucks is an essential aspect of risk management, ensuring that unexpected repairs don’t cripple your business. By understanding the key components and choosing the right truck repair insurance policy, you can navigate the road ahead with confidence, knowing your fleet is protected against the financial burden of unexpected repairs. Investing in comprehensive truck repair insurance is a proactive step towards maintaining a robust and efficient trucking operation.